Benefits of Qualified Opportunity Funds Waning

An investment in a QOF gives a taxpayer 3 potential tax benefits (one of which has expired).

A Qualified Opportunity Fund (QOF) is an investment vehicle which is organized as a corporation or partnership for the purpose of investing in qualified opportunity zone property acquired after December 31, 2017. The QOF must hold at least 90% of its assets in qualified opportunity zone (QOZ) property. A taxpayer may not invest directly in QOZ property, it must be done through a QOF.

Qualified Opportunity Zones (QOZ) are population census tracts that are generally in low-income communities that were specifically designated as QOZs after being nominated by the governor of the state or territory in which the community is located and approved by the Treasury Secretary. The purpose of a QOZ is to spur economic growth and job creation in low-income communities while providing tax benefits to investors.

Starting back in 2018, a taxpayer who had a capital gain on the sale or exchange of any property to an unrelated party could elect to defer, and potentially partially exclude, the gain from taxable income if the gain was reinvested in a QOF within 180 days of the sale or exchange. Unlike the requirement for Sec 1031 deferrals (tax deferred exchanges), where the total amount of proceeds must be used, any amount of the gain may be reinvested into a QOF.

The first tax benefit for a QOF investment is that any gain re-invested into a QOF is deferred in the year it would have been taxed. It becomes taxable December 31, 2026, or the date the QOF investment is sold, if sooner. Thus, if an individual invests in a QOF in 2023, that gives 3 years of deferral before becoming taxable at the end 2026.

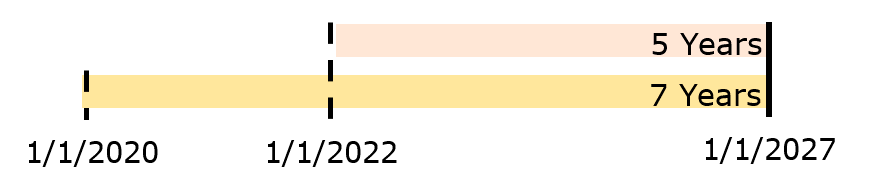

The second tax benefit for a QOF investment has expired, but is worth mentioning here for those who may have invested in prior years. As an incentive to invest in Qualified Opportunity Funds, the basis related to the capital gain invested in a QOF is increased by 10% of the deferred gain if the taxpayer retained the QOF investment for 5 years. That was increased to 15% if the QOF investment was retained for 7 years. In other words, if the investment was held at least 5 years, 10% of the original gain is permanently excluded, or if held 7 years, 15% of the original gain is permanently excluded. This benefit has essentially expired, as taxpayers just now investing in a QOF don’t have enough time to hold the investment the required 5 or 7 years to benefit from the 10% or 15% gain reductions, as the gains will be recognized in 2026.

As illustrated nearby, to meet the 7-year holding requirement, the QOF must have been purchased before 1/1/2020, and prior to 1/1/2022 to meet the 5-year holding period.

As illustrated nearby, to meet the 7-year holding requirement, the QOF must have been purchased before 1/1/2020, and prior to 1/1/2022 to meet the 5-year holding period.

The third tax benefit of investing in a QOF is considered by many to be the big prize. If the QOF investment is held for 10 years or longer, when it is sold the taxpayer can elect to increase their basis in the investment to fair market value. The effect of this adjustment is that none of the appreciation since the QOF was purchased is taxable when it is sold. No matter how large the gain, if the investment was held the required 10+ years, none of that gain is taxable.

Lastly, it is important to note that only QOF investments made from capital gains are eligible for any of the related tax benefits. An investment into a QOF that is not from capital gains is allowable, but is considered a non-qualified investment for purposes of the tax benefits.

SBF has opportunity zone experts on staff if you would like to discuss further.